Stock market project for high school student

Paul Tan. He is an 11th grade high school student from Oregon Episcopal School, Portland, Oregon. Through the program, he worked on a stock market project for high school student.

Paul is extremely bright, focused and engaged. He has an enthusiasm for mastering concepts and methods of stock market statistical analysis. He brought optimism and critical thinking to our mentorship sessions. He is passionate in stock market analysis and any related projects. His follow-through with effort on his project report demonstrated his understanding and mastery of stock market analysis.

University admissions

★ New York University (Shanghai Campus)

SCOPE OF THE PROGRAM – Stock Market Project for High School Student

Stock market project learning objectives

- Introduction to fundamental concepts of statistics and probability distributions

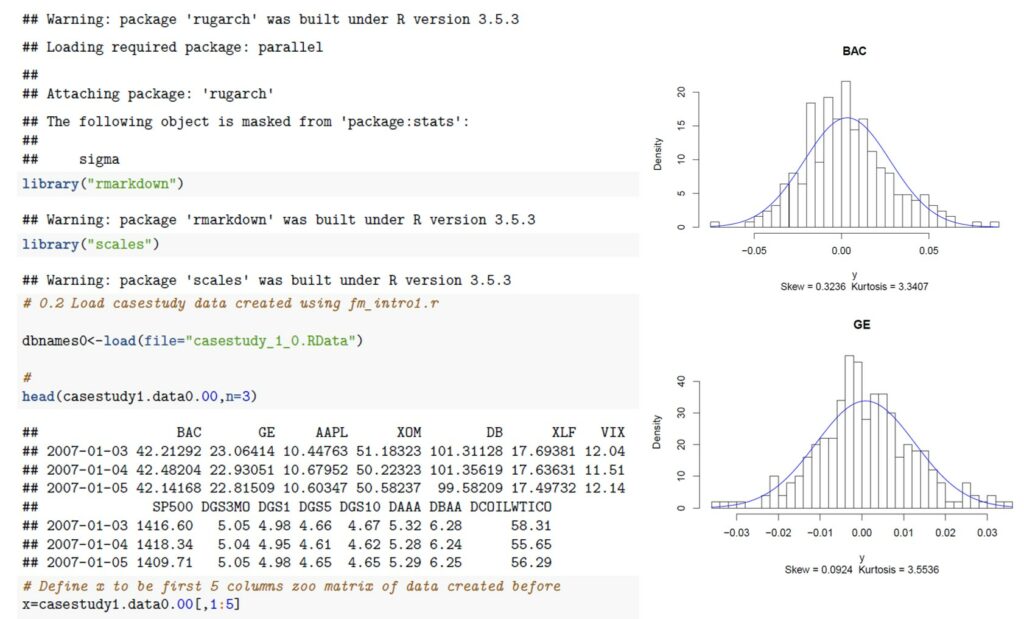

- Introduction to the statistics programming language / environment / R / RStudio

- Analysis of stock returns data, assessing skewness and kurtosis properties to evaluate consistency of returns distributions with the normal model.

What challenges did he face?

- Paul would like to prepare for his university studies by gaining a deeper learning into stock and dataset analysis.

- Paul is an inquisitive student, however his interests in stock market analysis were not taught in high school.

How did our program help him?

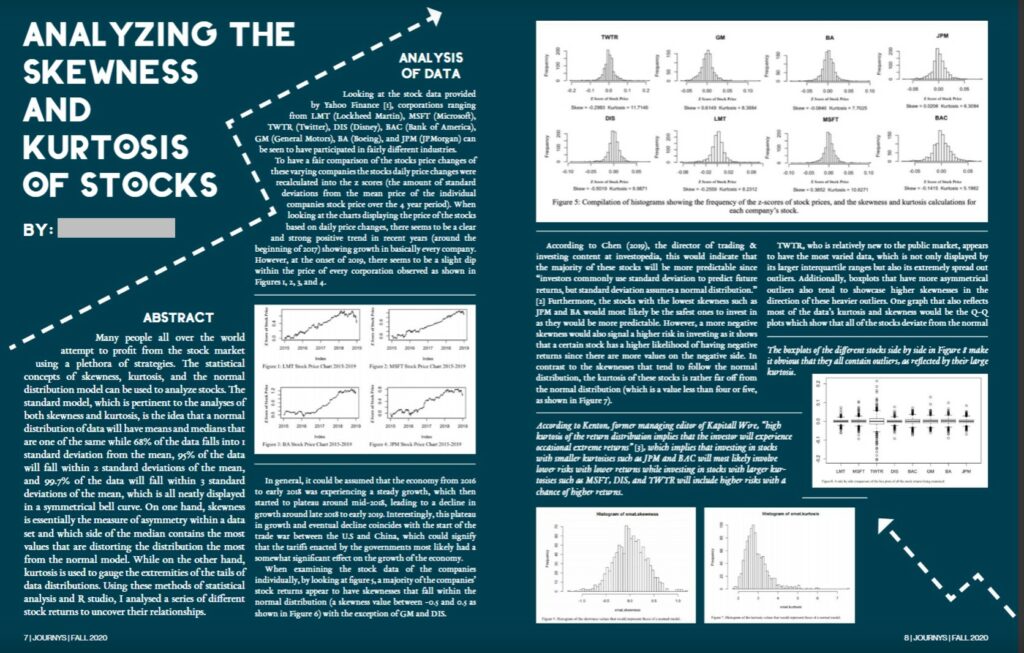

- The mentorship program has given Paul a chance to write a project report, which covers a thorough analysis of the skewness and kurtosis of daily returns for 8 stocks, computed annually.

Matched mentor in stock market project

The mentor is a lecturer at MIT’s mathematics department. He currently oversees systematic quantitative investment programs for retail clients and is licensed as an investment adviser in Massachusetts. He is a registered Commodity Trading Adviser with the National Futures Association and possesses the Series 3 and Series 65 licenses. He handled the management of trust assets as treasurer for both non-profit organizations and chaired the finance committees.

Recommendation letter

“I am happy to provide a strong recommendation of Paul to selective universities. Paul is extremely bright, focused and engaged. He has an enthusiasm for mastering concepts and methods of statistical analysis. He brought optimism and critical thinking to our mentorship sessions. Also, his follow-through with effort on his project report demonstrated his understanding and mastery of the project work.“

Lecturer from MIT

Excerpts from Paul’s stock market mentorship program

Through the stock market mentorship program, Paul completed a research paper on “Analyzing the skewness and kurtosis of stocks”, which later was published on JOURNYS Publication.

“The project report is extremely well written. It covers a thorough analysis of the skewness and kurtosis of daily returns for 8 stocks, computed annually. The discussion of the impact of skewness and kurtosis on risk and return is very clear. Furthermore it provides a useful way to compare investing in specific stocks.”

Lecturer from MIT

[TIPS] Topics for stock market project for high school student

There are many different stock market projects that high school students can work on to gain a better understanding of the stock market and investing. Here are some project ideas:

- Analysis of the impact of a specific news event on the stock market: Students can research a specific news event, such as a major company merger or a natural disaster, and analyze how it impacted the stock market.

- Comparative analysis of different investment strategies: Students can compare the performance of different investment strategies, such as value investing, growth investing, or income investing, and analyze the pros and cons of each strategy.

- Analysis of the impact of interest rates on the stock market: Students can research how changes in interest rates impact the stock market and analyze the performance of different sectors and industries during periods of rising or falling interest rates.

- Analysis of a specific publicly-traded company: Students can research a specific company and analyze its financial statements, industry trends, and competitive landscape. They can also compare the company’s performance to that of its competitors and the overall stock market.

- Analysis of the impact of macroeconomic factors on the stock market: Students can research how macroeconomic factors, such as GDP growth, inflation, or unemployment rates, impact the stock market and analyze the performance of different sectors and industries during periods of economic growth or recession.

- Analysis of the impact of geopolitical events on the stock market: Students can research how geopolitical events, such as wars or political unrest, impact the stock market and analyze the performance of different sectors and industries during periods of geopolitical instability.

- Analysis of the impact of social media on stock prices: Students can research how social media platforms, such as Twitter or Reddit, impact stock prices and analyze the performance of companies that are heavily discussed on these platforms.